Monetary Treason

How a Presidential Shadow Bank, a SuperPAC Called Fairshake, and Institutional Corruption Threaten the Republic

A Republic, If We Can Keep It

The Constitution was never meant to defend itself. It relies on an informed citizenry, active oversight, and leaders committed to its preservation. But what happens when those in power begin rewriting the rules, dismantling oversight, and monetizing the Executive Branch itself?

We are no longer dealing with isolated corruption or political gamesmanship. This is something far deeper, a structural shift that threatens the very foundation of American democracy.

The Illusion Is Cracking

The American people are living through one of the darkest chapters in our history, where a political family has staged a smoke-and-mirrors diversion, hoping to pull the wool over our eyes. But the illusion is breaking and the emperor has no clothes. The regime is cracking.

We now face a government where constitutional integrity is secondary to raw political power. The Executive Branch is aggressively consolidating power, dismantling long-standing norms, and eroding institutional trust.

At the Center: A Presidential Shadow Bank

At the heart of this transformation sits World Liberty Financial (WLF): a presidentially controlled shadow bank where profits flow directly to the First Family and governance is executed from within.

The GENIUS Act seeks to codify this oligarchy into law, legitimizing WLF and opening illicit backdoors to fund political campaigns and other campaign finance dark pools. Who knows, maybe the plan is to eventually get us all to transact in USD1, their latest “innovation” at World Liberty Financial. After all, the UAE just became the first country to accept stablecoin payments for commercial aviation.

The UAE is the same country that recently funneled $2 billion into World Liberty Financial. It’s only a matter of time before USD1 enters the mainstream for transactions: a private currency, fully controlled by the presidential family, where profits flow straight to them. You’re no longer the participant in the system, you’re the product.

And now, the mask is off.

On June 6th, Eric Trump announced on X: “$TRUMP has aligned with World Liberty Financial.” He went further, stating, “We’re proud to announce that World Liberty Financial plans to acquire a substantial position in $TRUMP for their Long-Term Treasury. We share a bigger vision for crypto, patriotism, and long-term success. Stay tuned for more to come.”

Let that sink in: the stablecoin USD1 isn’t looking to invest in U.S. Treasuries or the U.S. dollar. They want to dismantle it and replace it with $TRUMP.

America’s Immune System Is Being Deliberately Weakened

At the same time, our institutional watchdogs—the very agencies meant to uphold accountability—are being captured, bypassed, or rendered impotent.

Congressional oversight committees are being stonewalled

Office of Government Ethics (OGE) is ignored or dismantled

Office of Special Counsel (OSC) is overwhelmed and dysfunctional

Hatch Act enforcement committee? Gone

CFTC: Understaffed, Undermined, and Boxed Out of Crypto Oversight

June 17 Update: The Trump-appointed pick for the CFTC is poised to run a one-man show in shaping U.S. crypto regulation. Brian Quintenz, formerly Head of Policy at Andreessen Horowitz’s a16z crypto arm, is positioned to become the sole voice on the Commission. This isn’t oversight. It’s consolidation. Meanwhile, Chairman Caroline Pham has responded to public inquiry into the constitutionality of pending digital asset legislation by deleting my comment and blocking my account, rather than addressing the substance of the concern.

This is what regulatory capture looks like in real time.

Treasury Department? Silent

DOJ Public Integrity Section: Dismantled

SEC? Compromised. Apparently, nothing qualifies as a security anymore, and constitutional violations no longer warrant a response. July 24 Update: The head of SEC Enforcement has resigned: the same day Congress set as the deadline for the agency to respond to formal record preservation requests tied to Binance, World Liberty Financial, Congress, and the Executive Branch. Coincidence?

This resignation came as a specific administrative rule went into effect that began blocking my emails from enforcement@SEC.gov. I’ve sent over 30 emails and left 20 voicemails, all ignored.

These agencies represent the immune system of our democracy, and they’re being deliberately weakened. Oversight is no longer a democratic safeguard; they’ll just call it “deregulation,” or spin it as a partisan attack.

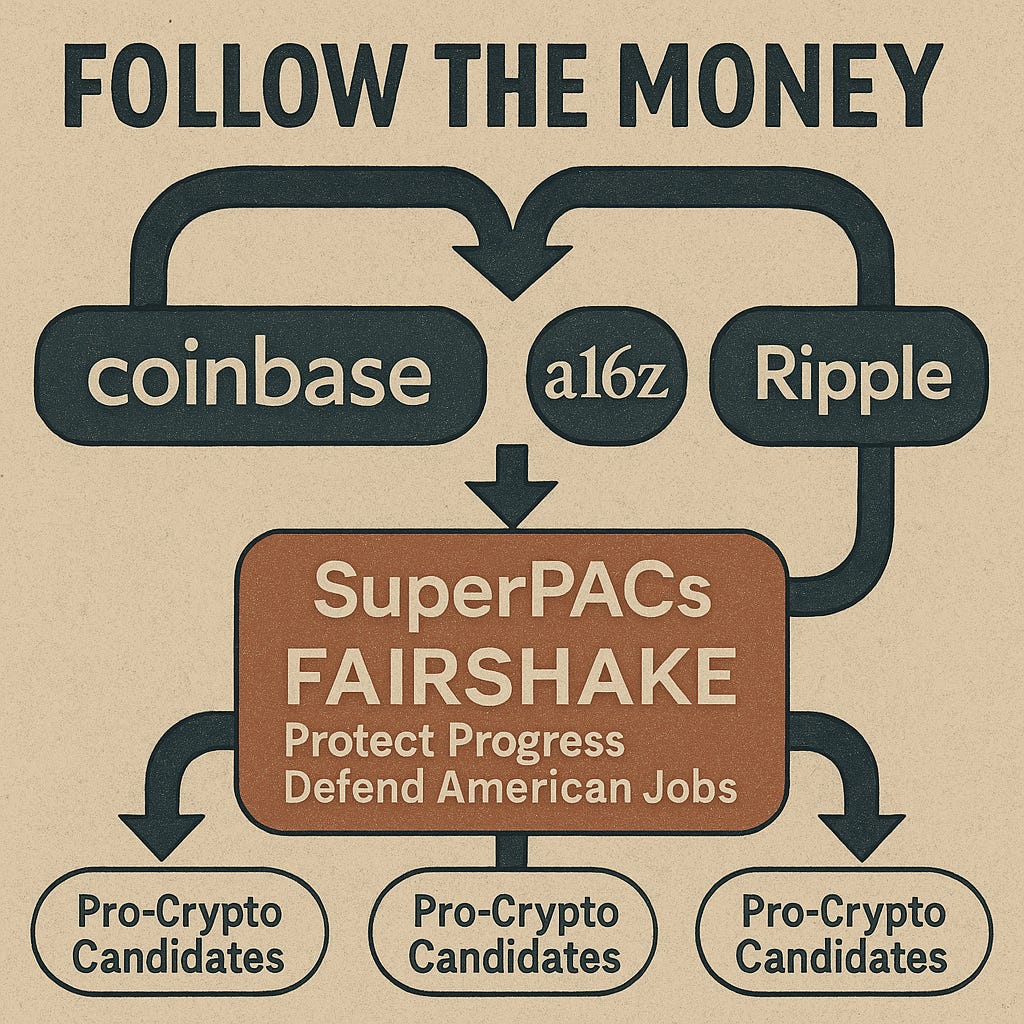

Follow the Money: The SuperPACs Engineering the Takeover

Backing this scheme is a well-financed crypto machine.

SuperPACs like Fairshake (now the largest in the country at $260 million), Protect Progress, and Defend American Jobs are all funded by Coinbase, a16z, Ripple, and other crypto giants.

They are flooding the airwaves and political system with ad dollars to install “pro-crypto” candidates. It’s no coincidence that many of the candidates boosted by Fairshake and its sister PACs have either sponsored or signaled support for legislation like the GENIUS Act.

Crypto Lobbying as a Trojan Horse

Crypto lobbying groups like the Blockchain Association, Crypto Council for Innovation, and The Digital Chamber are funded by the same interests backing the superPACs.

They flood Congress with bills under the banner of “innovation,” while staying silent about this constitutional breach and structural damage it causes.

Their role in shaping the GENIUS Act (which cements the legality of WLF) reveals their true allegiance: not to decentralization or transparency, but to political access and monetary capture.

Normalization of Financial Crimes and Presidential Pardons

While oversight disintegrates, the Executive Branch is pardoning those convicted of money laundering. We are no longer persecuting financial crimes, we are incentivizing them.

The SEC just dropped its case against Binance, mere days after it became the exchange of choice for the WLFs USD1. Binance pleaded guilty to money laundering and settled with the US government for $4.3 billion. Its CEO walked out of jail and is now seeking a presidential pardon. With the SEC offering no resistance, he’s picking up right where he left off, proposing to create a dark pool perpetual swap decentralized exchange (DEX) in the name of “preventing market manipulation.”

The Crypto Capture of Financial Oversight

And who represents both Binance and the presidential family’s shadow bank, World Liberty Financial? The same attorney once floated to lead the SEC: Teresa Goody Guillén, now at BakerHostetler. Guillén’s dual representation of both a global crypto exchange accused of massive money laundering and a shadow central bank operating under executive influence speaks volumes. But instead of facing scrutiny, she was nearly appointed to lead the SEC herself.

That position ultimately went to Paul Atkins, in a quiet but calculated move. A former SEC commissioner during the lead-up to the 2008 financial crisis, Atkins now returns with the same deregulatory ideology that helped fuel the last global meltdown. This time, however, the stakes are higher.

Widely celebrated by crypto advocates, Atkins has deep industry ties. Including personal crypto holdings worth over $6 million prior to his nomination. His resume includes advisory roles with digital asset firms like Securitize and Anchorage Digital, and leadership in the Token Alliance. While he pledged to divest, no public record confirms the completion of these sales.

Atkins’ appointment has coincided with aggressive staff reductions at the SEC, slashing nearly 17% of the agency’s workforce. Critics argue this weakens the Commission’s ability to oversee markets, enforce laws, and protect investors. In an era of rapidly expanding financial innovation and fraud, the American people are left to wonder: who is protecting the public interest, and who is cashing in on its collapse?

The Commodity Futures Trading Commission (CFTC), another critical financial regulator, is operating with only one confirmed commissioner, leaving systemic gaps at the worst possible time. At the same time, legislation like the Digital Asset CLARITY Act threatens to confuse regulatory boundaries and undermine existing protections in traditional equity and debt markets. As the crypto industry floods Washington with lobbying dollars, the CFTC is being sidelined, its regulatory authority diluted at the precise moment it’s needed most.

The Federal Reserve and Big Beautiful Bill

The administration is actively undermining the independence of the Federal Reserve, attacking the laws designed to prevent ideological capture and enforce checks and balances.

Buried in the so-called “Big Beautiful Bill” are provisions that should alarm every American:

Section 899: A “revenge tax” that penalizes foreign holders of U.S. Treasuries. Potentially destabilizing financial markets and raising the cost of borrowing and home ownership for American families.

Section 70302: Strips federal courts (including the Supreme Court) of the ability to enforce contempt orders against officials who defy judicial rulings.

Section 43201: A 10-year federal takeover of AI governance that preempts all state-level regulation, stripping states of their constitutional right to safeguard citizens from unchecked algorithmic power, mass surveillance, and cognitive manipulation. Given the DOGE and Palantir directive, it lays the foundation for a federally controlled super-surveillance state.

We’ve seen this movie before. From Nixon closing the gold window, to autocratic regimes consolidating monetary and judicial control, every great democracy that fell began with a slow unraveling of institutions.

We are living through a hostile takeover of our monetary sovereignty. If We the People do not rise and demand accountability, we may not get another chance.

The Clock Is Ticking…We Either Stand United, or Falter Divided.

The choice is ours. But time is running out. What You Can Do.

• Share this report. Wake up your networks, awareness is our first defense.

• Contact your representatives. Demand immediate investigations into World Liberty Financial, the GENIUS Act, and the SuperPACs fueling this constitutional breach.

• Call on journalists and regulators. The SEC, the CFTC, the Office of Government Ethics, they need to hear from the public.

• Reject normalization of corruption. Speak out. Organize. Hold the line.

This is our final line in the sand. We The People must rise as one, united.

We are living through a test of civic courage. History is watching.

We either preserve the Republic…or lose it to a regime cloaked in innovation, but fueled by impunity.

The Founders warned us the Republic would only survive if we could keep it. That responsibility now rests with us. Not later. Not tomorrow. Now.

Monetary Treason Definition: The deliberate subversion or manipulation of a nation’s monetary system, such as its currency, central banking functions, or legal tender status, in ways that threaten democratic accountability, violate constitutional checks and balances, or serve the interests of private individuals, political actors, or foreign powers over the public good.

For those who want to see the legal blueprint behind the WLF unraveling, here are the specific constitutional provisions under threat (Full analysis in Meta-Crisis of Trust series):

1. Foreign Emoluments Clause (Art. I, Sec. 9, Cl. 8): Accepting financial benefits from foreign entities without congressional approval.

2. Domestic Emoluments Clause (Art. II, Sec. 1, Cl. 7): Profiting from the presidency beyond official compensation via crypto-linked ventures.

3. Separation of Powers: Undermining Federal Reserve independence by creating parallel monetary structures controlled by the executive, while challenging Humphrey’s Executor.

4. Article II, Section 4: Abuse of office and self-enrichment may rise to impeachable offenses.

5. 22nd Amendment concerns: Building tokenized loyalty networks that function as shadow political infrastructure beyond term limits.

6. Appropriations Clause (Art. I, Sec. 9, Cl. 7): Bypassing congressional control of public funds via private, tokenized finance.

7. 1st Amendment campaign finance violations: Undisclosed, unregulated political influence through pay-to-play crypto ecosystems.

8. Due Process & Equal Protection: Creating unequal political access based on wealth and insider connections.

The U.S. Constitution explicitly grants monetary authority to Congress under Article I, Section 8, which enumerates the powers of Congress.

The relevant clause is:

Clause 5: “The Congress shall have Power … To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures.”

This clause establishes that:

Congress, not the Executive Branch or private actors, has the sole constitutional authority to create and regulate money.

It includes the power to determine what constitutes legal tender, how it is valued, and how it is standardized across the nation.

Further Constitutional Reinforcement: Article I, Section 10: Powers Denied to the States

Clause 1 of Section 10 further strengthens the constitutional framework by explicitly denying individual states any authority over monetary policy:

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts…”

This clause makes it unambiguous that:

Only Congress holds the power to coin money and issue legal tender.

States are constitutionally barred from creating their own currency or designating alternative forms of payment.

The Founders intentionally centralized monetary authority at the federal level to ensure national uniformity, trust, and stability in the U.S. monetary system.

Together, Article I, Section 8 and Section 10 codify a clear constitutional mandate: monetary sovereignty resides solely with the federal legislative branch; not with states, the executive, or private actors.

Wow! A damning indictment for sure: "We are living through a hostile takeover of our monetary sovereignty. If We the People do not rise and demand accountability, we may not get another chance. The Clock Is Ticking…We Either Stand United, or Falter Divided. "

You make the compelling case that advancing a plan to liberate from the banking cartels, and now the tech-bros and the digital currency program, is key if we the people want to avoid a techno-totalitarian fate.

Toby, you are welcome to attend our discussion on democratizing the money supply tomorrow; or catch it when it is posted. Howard Switzer, a proponent for monetary reform at Green Party US, Banking and Monetary Reform Committee, presents first in our series.

You don't have to be a "green" to attend. Open to the public; Find the link to attend here: https://greenlibertycaucus.org/series-on-making-greens-win/

Excellent article. Green Liberty offers our full support green-liberty.org.